Notice of Annual Meeting and Proxy Statement

Annual Meeting of Stockholders to be held on June 8, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | ||

Confidential, FOR Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | ||

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to |

EverQuote, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

| ☒ | No fee | |||

| ☐ | ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| Fee paid previously with preliminary | ||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act | |||

| ||||

| ||||

| ||||

0-11 | ||||

Notice of Annual Meeting and Proxy Statement

Annual Meeting of Stockholders to be held on June 8, 2023

Our Mission

To empower insurance shoppers to better protect life’s most important assets—their family, health, property, and future.

Our Values

BOOTSTRAPPING: We bootstrap our growth

EverQuote was built as a bootstrap, largely funding our growth under our own power. Today, this approach continues to enable us to retain control over our destiny. With every new thing we do, we value speed to unit profitability, and expect initiatives to drive increasing value as they scale.

TENACITY: We are tenacious entrepreneurs

We have fire and grit. We think constantly about reducing the friction and cost of protecting consumers’ most important assets. We are impatient to change a massive industry and are energized about building a mammoth business as we do it.

DATA CENTRICITY: We are data driven

We expect discussions at all levels to be rooted in and guided by data and follow our north star of getting the consumer protected. We believe data democratizes decision making and enables us to embrace diversity of perspectives and direct, if not always comfortable, communication.

IMPACT: We are obsessed with execution

Effort matters, but consistent execution wins. We are proactive, solution-oriented owners focused on generating high value for our customers. We test, learn and adapt with urgency to execute against our ambitious goals.

HEART: We have fun together as we work together

Goats are high achievers, but life is too short not to have fun and enjoy the company of our colleagues. We recognize that collaboration is key to our success, and we seek to create a respectful and inclusive environment for all employees, partners and customers. We also value honesty and integrity, and realize that our actions reflect on ourselves and our community.

April 28, 2023

Dear Fellow Stockholders,

EverQuote’s mission is to empower insurance shoppers to better protect life’s most important assets – their family, health, property, and future. To achieve this mission, we remain steadfast in our pursuit of becoming the largest online source of insurance policies by using data, technology and knowledgeable advisors to make insurance simpler, more affordable and personalized. In 2022, EverQuote expanded on its leadership position and gained market share, as we continued to work to redefine the category of insurance distribution and to build the one-stop insurance destination for the digital age.

In 2022, we delivered full year revenue and Variable Marketing Margin, or VMM, of $404.1 million and $128.3 million, respectively, while generating positive Adjusted EBITDA. Last year proved to be a formidable year for us, as the challenging auto insurance market tested our team’s resolve and our business model’s resilience. Throughout the year, our team continued to demonstrate its agility and strength by adjusting operations to a rapidly changing environment in order to deliver solid financial results. Our customer acquisition teams drove higher ad spend efficiency and our agent distribution channels proved resilient, enabling us to achieve a record annual level of VMM as a percentage of revenue and a nearly 20% year-over-year increase in consumers shopping in our marketplace. We implemented disciplined expense management to generate positive Adjusted EBITDA for 2022.

Looking to 2023, we continue to make steady progress to capture a market opportunity that remains enormous. Insurance distribution and advertising is a $171 billion market and we are prepared with the assets, team, and conviction to deliver the type of insurance shopping experience that we believe the industry, including carriers, agents, and consumers, ultimately needs to bring the full potential of the digital age to insurance buying and selling.

We have assembled a highly effective combination of insurance distribution assets by integrating capabilities from our marketplace and Direct-to-Consumer agency, or DTC, which we refer to as our “hybrid marketplace.” This unique strategy supports the broadest range of carriers in their pursuit of profitable growth. From the consumer’s perspective, our hybrid marketplace enables access to a comprehensive set of insurance products across major personal lines, resulting in each consumer being more likely to find the right product for them, delivered in their preferred manner.

EverQuote continues to be a data and technology company first. This element of our DNA has enabled us to scale our customer acquisition platform into one of the largest sources of online insurance policies in the U.S. Our strength continues to build and compound as we amass more data and deploy machine learning and artificial intelligence capabilities across more aspects of our business over time. As we leverage our data and technology advantage, we are driving wide-ranging improvements to our marketplace, from enhancing traffic bidding to experience personalization to product recommendations. We are also deepening our competitive moat by making our marketplace more effective for both consumers and insurance providers, and more efficient for EverQuote.

I would like to thank our customers, partners and stockholders for their ongoing support and for believing in EverQuote’s vision. I especially want to express my gratitude to our employees for their tireless work ethic, dedication, and passion in building our company. Our experienced team is energized by the opportunity ahead, as we continue to build the industry’s preeminent one-stop insurance destination.

Sincerely,

Jayme Mendal

Chief Executive Officer

April 29, 202028, 2023

Dear EverQuote Stockholder:

I am pleased to invite you to attend the 20202023 Annual Meeting of Stockholders (the “Annual Meeting”) of EverQuote, Inc. (“EverQuote”) to be held via the internet atas a virtual web conference athttps://www.virtualshareholdermeeting.com/EVER2020www.virtualshareholdermeeting.com/EVER2023 on Thursday, June 11, 2020,8, 2023, at 10:00 a.m., Eastern Time. To support the health and well-being of our stockholders, employees and directors in light of the recent novel coronavirus(“COVID-19”) outbreak, our Annual Meeting will be a “virtual meeting” of stockholders, which will be conducted exclusively via the internet at a virtual web conference. There will not be a physical meeting location, and stockholders will not be able to attend the Annual Meeting in person. This means that you can attend the Annual Meeting online, vote your shares during the online meeting and submit questions during the online meeting by visiting the above-mentioned internet site. In light of the public health and safety concerns related toCOVID-19, we believe that hosting a “virtual meeting” will enable greater stockholder attendance and participation from any location around the world. We intend to resume holding anin-person meeting next year.

Details regarding the meeting and the business to be conducted are more fully described in the accompanying Notice of 20202023 Annual Meeting of Stockholders and Proxy Statement.

Pursuant to rules of the Securities and Exchange Commission that allow issuers to furnish proxy materials to stockholders over the internet, we are posting the proxy materials on the internet and delivering a noticeNotice of internet availabilityInternet Availability of the proxy materials.materials (the “Notice”). On or about April 29, 2020,28, 2023, we will begin mailing to our stockholders athe Notice, of Internet Availability (the “Notice”) containingwhich will contain instructions on how to access or request a copy of our Proxy Statement for the Annual Meeting and our Annual Report on Form10-K for the year ended December 31, 2019.2022.

Your vote is important. Whether or not you plan to attend the Annual Meeting online, I hope you will vote as soon as possible. You may vote over the internet or during the meeting or, if you requested printed copies of proxy materials, you may also vote by mailing a proxy card or voting by telephone. Please review the instructions regarding your voting options on the Notice or, if you requested printed copies of your proxy materials, on the proxy card regarding your voting options.card.

We look forward to seeing you at our virtual Annual Meeting.

Sincerely,

Seth BirnbaumJayme Mendal

President and Chief Executive Officer

YOUR VOTE IS IMPORTANT

In order to ensure your representation at the Annual Meeting, whether or not you plan to attend the Annual Meeting online, please vote your shares as promptly as possible over the internet by following the instructions on your Notice or, if you requested printed copies of your proxy materials, by following the instructions on your proxy card. Your participation will help to ensure the presence of a quorum at the Annual Meeting and save EverQuote the extra expense associated with additional solicitation. If you hold your shares through a bank, broker, trustee or other nominee, your bank, broker, trustee or other nominee is not permitted to vote on your behalf in the election of directors, unless you provide them with specific instructions to the broker by completing and returning any voting instruction form that the broker providesthey provide (or following any instructions that allow you to vote your broker-held shares via telephone or the internet). For your vote to be counted, you will need to communicate your voting decision in accordance with the instructions set forth in the proxy materials. Voting your shares in advance of the meeting will not prevent you fromfrom: (i) attending the Annual Meeting online, (ii) revoking your earlier submitted proxy in accordance with the instructions set forth in the proxy materials, or (iii) voting your shares during the meeting.

EVERQUOTE, INC.

210 Broadway

Cambridge, MA 02139

NOTICE OF 20202023 ANNUAL MEETING OF STOCKHOLDERS

Please take notice that the 20202023 Annual Meeting of Stockholders of EverQuote, Inc. (the “Annual Meeting”) will be held on Thursday, June 11, 2020,8, 2023, at 10:00 a.m., Eastern time. This year’sTime. The Annual Meeting will be a completely “virtual meeting”virtual meeting of stockholders. You will be able to attend the Annual Meeting online, vote your shares during the online meeting and submit your questions during the Annual Meeting via live webcastvirtual meeting by visitinghttps://www.virtualshareholdermeeting.com/EVER2020www.virtualshareholdermeeting.com/EVER2023. The Annual Meeting will be held for the following purposes:

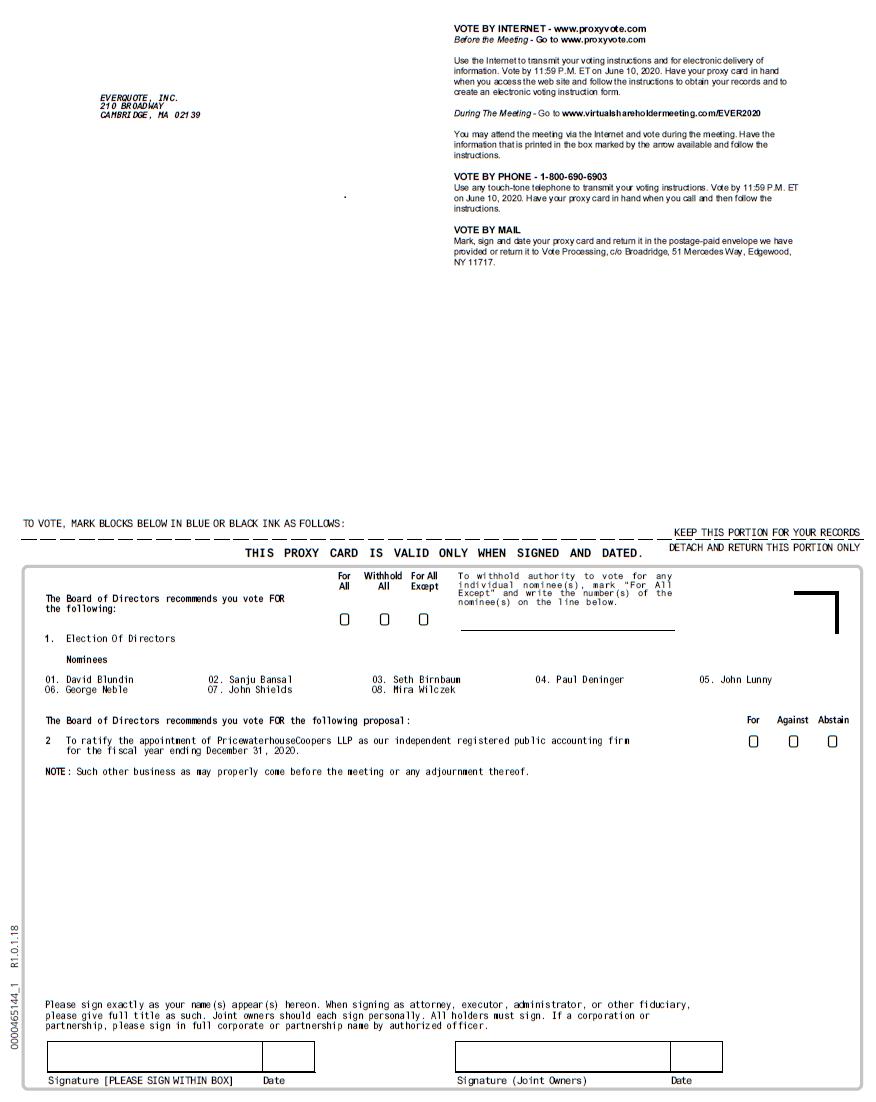

To elect eightseven directors, David Blundin, Sanju Bansal, Seth Birnbaum, Paul Deninger, John Lunny,Jayme Mendal, George Neble, John Shields and Mira Wilczek, to hold office until our 20212024 annual meeting of stockholders or until their successors are duly elected and qualified, subject to their earlier death, resignation or removal;

To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020;2023; and

To transact any other business that properly comes before the Annual Meeting (including adjournments and postponements thereof).

In light of the recent novel coronavirusCOVID-19 outbreak, for the health and well-being of our stockholders, employees and directors, we have determined that theThe Annual Meeting will be held in a virtual meeting format only, via the internet, with no physicalin-person meeting. At our virtual Annual Meeting, stockholders will be able to attend, vote and submit questions by visitinghttps://www.virtualshareholdermeeting.com/EVER2020www.virtualshareholdermeeting.com/EVER2023. Further information about how to attend the Annual Meeting online, vote your shares online during the meeting and submit questions during the meeting is included in the accompanying proxy statement.statement (the “Proxy Statement”).

Only holders of record of our Class A common stock and Class B common stock at the close of business on April 13, 202010, 2023 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting as set forth in the enclosed proxy statement (the “Proxy Statement”).Proxy Statement. You are entitled to attend the Annual Meeting only if you were a stockholder as of the close of business on the Record Date or hold a valid proxy for the Annual Meeting. If you are a stockholder of record, your ownership as of the Record Date will be verified prior to admittance into the virtual meeting. Please allow

ample time for the admittance process. If you are not a stockholder of record but hold shares through a bank, broker, trustee or other nominee, you will receive instructions from the holder of record that you must follow for your shares to be voted. Please

allow ample time for the admittance process. A complete list of registered stockholders will be available for the examination of any stockholder, for any purpose germane to the meeting for a period of at least 10 days prior to the Annual Meeting for a purpose germane to the meeting by sending an email to annualmeeting@everquote.com, stating the purposedate, during ordinary business hours at EverQuote’s principal place of the request and providing proof of ownership of Company stock.business located at 210 Broadway in Cambridge, Massachusetts 02139. The list of these stockholders will also be available on the bottom of your screen during the Annual Meeting after entering the control number included on the Notice of Internet Availability of Proxy Materials that you received, on your proxy card, or on the materials provided by your bank, broker, trustee or broker.other nominee. For instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail, the section titled “Voting” beginning on page 2 of the attached Proxy Statement or, if you requested to receive printed proxy materials, your enclosed proxy card.

By Order of our Board of Directors,

David MasonJulia Brncic

General Counsel and Secretary

Cambridge, MA

April 29, 202028, 2023

| GENERAL INFORMATION | 1 | ||||||

| 9 | |||||||

| 11 | |||||||

| 12 | |||||||

Executive Compensation | |||||||

| 14 | |||||||

PROPOSAL | |||||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | |||||||

| 21 | |||||||

| 24 | |||||||

| 25 | |||||||

| 26 | |||||||

| 27 | |||||||

| 28 | |||||||

| 31 | |||||||

| 31 | ||||||

This Proxy Statement contains statements reflecting our views about our future performance that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (Reform Act). Statements that constitute forward-looking statements within the meaning of the Reform Act are generally identified through the inclusion of words such as “anticipate,” “believe,” “estimate,” “expect,” “confident,” “forecast,” “future,” “goal,” “guidance,” “intend,” “may,” “objective,” “outlook,” “plan,” “position,” “potential,” “project,” “seek,” “should,” “strategy,” “target,” “will” or similar statements or variations of such words and other similar expressions. All statements addressing our future operating performance, and statements addressing events and developments that we expect or anticipate will occur in the future, are forward-looking statements within the meaning of the Reform Act. These forward-looking statements are based on currently available information, operating plans and projections about future events and trends. They inherently involve risks and uncertainties that could cause actual results to differ materially from those predicted in any such forward-looking statement. These risks and uncertainties include, but are not limited to, those described in “Item 1A. Risk Factors” starting on page 11 of our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the Securities and Exchange Commission on February 27, 2023. Investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made. We undertake no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

PROXY STATEMENT

FOR THE 20202023 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD

THURSDAY, JUNE 11, 20208, 2023

Our board of directors solicits your proxy on our behalf for the 20202023 Annual Meeting of Stockholders (the “Annual Meeting”), and at any postponement or adjournment of the Annual Meeting, for the purposes set forth in this Proxy Statement. To support the health and well-being of our stockholders, employees and directors in light of the recent novel coronavirus(“COVID-19”) outbreak, theThe meeting will be held via the internet atas a virtual web conference athttps://www.virtualshareholdermeeting.com/EVER2020EVER2023 on Thursday, June 11, 2020,8, 2023, at 10:00 a.m., Eastern Time. We intend to mail a Notice of Internet Availability of Proxy Materials to stockholders of record and to make this Proxy Statement and accompanying materials available on the internet on or about April 29, 2020.28, 2023.

In this Proxy Statement, the terms “EverQuote,” “the company,” “we,” “us,” and “our” refer to EverQuote, Inc. The mailing address of our principal executive offices is EverQuote, Inc., 210 Broadway, Cambridge, MA 02139. All website addresses set forth in this Proxy Statement are for information only and are not intended to be an active link or to incorporate any website information into this document.

We are an “emerging growth company” under applicable federal securities laws and therefore permitted to take advantage of certain reduced public company reporting requirements. As an emerging growth company, we provide in this Proxy Statement the scaled disclosure permitted under the Jumpstart Our Business Startups Act of 2012, including the compensation disclosures required of a “smaller reporting company,” as that term is defined in Rule12b-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We may remain an emerging growth company until December 31, 2023, provided that, if the market value of our common stock that is held bynon-affiliates exceeds $700 million as of any June 30 before that time or if we have annual gross revenues of $1.07 billion or more in any fiscal year, we would cease to be an emerging growth company as of December 31 of that year.IMPORTANT INFORMATION ABOUT THE PROXY PROCESS AND VOTING

| Virtual Meeting |

| The Annual Meeting will be |

| ||

Attending the Meeting | We will host the Annual Meeting |

| Internet Availability of Proxy Materials | We are providing access to our proxy materials over the internet. On or about April | |

| Record Date | April | |

| Stockholders Entitled to Vote | A complete list of registered stockholders |

| Quorum | A majority of the voting power of all issued and outstanding shares of our Class A common stock and Class B common stock (voting together as a single class) entitled to vote on the Record Date must be virtually present during the meeting or represented by proxy to constitute a quorum. | |

| Shares Outstanding | 27,384,243 shares of Class A common stock and | |

| ||

| Voting | There are four ways a stockholder of record can vote: | |

(1) |

|

(2) | By Telephone: If you are a stockholder as of the Record Date, you may vote by telephone by following the |

(3) | By Mail: If you requested printed copies of proxy materials and are a stockholder as of the Record Date, you may vote by mailing your proxy as described in the proxy materials. |

(4) | During the Meeting: If you are a stockholder as of the Record Date, you will have the ability to attend the virtual meeting and vote online during the meeting. The Annual Meeting will be a virtual only meeting, which can be accessed at |

In order to be counted, proxies submitted by telephone or internet must be received by 11:59 p.m., Eastern Time, on June |

If you hold your shares through a bank, broker, trustee or |

| Revoking Your Proxy | Stockholders of record may revoke their proxies by virtually attending the Annual Meeting and voting during the meeting, by filing an instrument in writing revoking the proxy or by filing another duly executed proxy bearing a later date with our Secretary before the vote is counted or by voting again using the telephone or internet before the cutoff time (11:59 p.m., Eastern Time, on June | |

| Voting Rights | Holders of our Class A common stock are entitled to one vote per share of Class A common stock held on the Record Date in respect of any proposal presented at the Annual Meeting. Holders of our Class B common stock are entitled to ten votes per share of Class B common stock held on the Record Date in respect of any proposal presented at the Annual Meeting. | |

| Votes Required to Adopt Proposals | For Proposal | |

| For Proposal |

| Effect of Votes Withheld, Abstentions and BrokerNon-Votes | Votes withheld, | |

Under |

| Voting Instructions | If you complete and submit your proxy voting instructions, the persons named as proxies will follow your instructions. If you submit proxy voting instructions but do not direct how your shares should be voted on each item, the persons named as proxies will voteFORthe election of the nominees for directors andFORthe ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm. The persons named as proxies will vote on any other matters properly presented at the Annual Meeting in accordance with their best judgment, although we have not received timely notice of any other matters that may be properly presented for voting at the Annual Meeting. | |

| Voting Results | We will announce preliminary results at the Annual Meeting. We will report final results by filing a Current Report on Form 8-K, or Form 8-K, within four business days after the Annual Meeting. If final results are not available at that time, we will provide preliminary voting results in theForm 8-K and final results in an amendment to theForm 8-K after they become available. | |

| Additional Solicitation/Costs | We are paying for the distribution of the proxy materials and solicitation of the proxies. |

solicit proxies on our behalf in person, by telephone, email or facsimile, but they do not receive additional compensation for providing those services. |

Householding | Some |

ELECTION OF DIRECTORS

NumberThe first proposal on the agenda for the Annual Meeting is the election of Directors; Board Structure

Our board of directors currently consists of eight members, elected each yearseven director nominees to serve for a one-year term beginning at the Annual Meeting and ending at our 2024 annual meeting of stockholders, for a term of one year.or the 2024 Annual Meeting. The terms of our current directors expire at the Annual Meeting. Directors are elected to hold office for aone-year term or until the election and qualification of their successors in office, subject to their earlier death, resignation or removal.

Under Mr. Auguste and Mr. Lunny are current directors who are not standing for re-election at the termsAnnual Meeting. Accordingly, our board of a voting agreement, which we refer to asdirectors reduced the Link voting agreement, each of Seth Birnbaum and Tomas Revesz has agreed to vote on all matters presented to our stockholders all voting capital stock held by him in the manner directed by Link Ventures, LLLP. The Link voting agreement is the only agreement containing contractual obligations regarding the electionsize of our directors. The Link voting agreement will continue in full forceboard of directors from nine members to seven members, effective immediately following the completion of Mr. Auguste and effect until terminated by written consent of Link Ventures, LLLP in its sole discretion.

NomineesMr. Lunny’s terms at the Annual Meeting.

Our board of directors has nominated David Blundin, Sanju Bansal, Seth Birnbaum, Paul Deninger, John Lunny,Jayme Mendal, George Neble, John Shields and Mira Wilczek for election as directorsre-election to the board to hold office untilfor a one-year-term expiring at our 2021 annual meeting of stockholders2024 Annual Meeting or until their successors are duly elected and qualified, subject to their earlier death, resignation or removal. Each of the nominees is a current member of our board of directors and has consented to serve if elected.

Unless you direct otherwise through your proxy voting instructions, the persons named as proxies will vote all proxies received“FOR” “FOR”the election of each nominee. If any nominee is unable or unwilling to serve at the time of the Annual Meeting, the persons named as proxies may vote for a substitute nominee chosen by the members of our board of directors. In the alternative, the proxies may vote only for the remaining nominees, leaving a vacancy on our board of directors.

Our board of directors may fill such vacancy at a later date or reduce the size of our board of directors. We have no reason to believe that any of the nominees will be unwilling or unable to serve if elected as a director.

Recommendation of our Board of Directors

The board of directors recommends that you vote “FOR” the election of each of David Blundin, Sanju Bansal, Seth Birnbaum, Paul Deninger, John Lunny,Jayme Mendal, George Neble, John Shields and

Mira Wilczek as directors.

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The biographies of each of the director nominees and continuing directors below containcontains information regarding each such person’s service as a director on our board of directors, business experience and other experiences, qualifications, attributes or skills that caused our board of directors to determine that the person should servenominate him or her as a director of the company.director. In addition to the information presented below regarding each such person’s specific experience, qualifications, attributes and skills that led our board of directors to the conclusion that he or she should serve as a director, we also believe that each of our directors has a reputation for integrity, honesty and adherence to high ethical standards. Each of our directors has demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to our company and our board of directors, including a commitment to understanding our business and industry. We also value our directors’ experience in relevant areas of business management and on other boards of directors and board committees.

Below is information regarding our director nominees and directors whose terms are continuing after the Annual Meeting.Meeting:

Name | Age | EverQuote Director Since | Independent | Committee Membership | Age | EverQuote Director Since | Independent | Committee Membership | ||||||||||||||

Sanju Bansal | 57 | 2014 | Yes | Audit Committee | ||||||||||||||||||

David Blundin | 53 | 2008 | No | — | 56 | 2008 | No | — | ||||||||||||||

Sanju Bansal | 54 | 2014 | Yes | Audit Committee | ||||||||||||||||||

Seth Birnbaum | 46 | 2010 | No | — | ||||||||||||||||||

Paul Deninger | 61 | 2019 | Yes | Audit Committee, Compensation Committee | 64 | 2019 | Yes | Audit Committee, Compensation Committee | ||||||||||||||

John Lunny | 54 | 2014 | Yes | Compensation Committee | ||||||||||||||||||

Jayme Mendal | 37 | 2020 | No | — | ||||||||||||||||||

George Neble | 63 | 2018 | Yes | Audit Committee | 66 | 2018 | Yes | Audit Committee | ||||||||||||||

John Shields | 67 | 2018 | Yes | Audit Committee | 70 | 2018 | Yes | Audit Committee | ||||||||||||||

Mira Wilczek | 38 | 2017 | No | Compensation Committee | 41 | 2017 | No | Compensation Committee | ||||||||||||||

David Blundin, one of ourco-founders, has served as chairman of our board of directors since August 2008. Mr. Blundin is the founder of Link Ventures, where he has served as managing partner since January 2006. He is also theco-founder of Vestigo Ventures LLC, a venture capital firm, where he has served as managing partner since January 2016. In June 2005, Mr. Blundinco-founded Cogo Labs, Inc., a technology incubator, data analytics and quantitative marketing company, where he has served as the chairman since its founding and also served as chief executive officer from its founding to February 2017. Previously, Mr. Blundin was the chairman of Autotegrity, Inc., a data analytics and online marketing company that heco-founded, from 2008 until its sale to ADP in 2011, and chief technologist at Vignette Corporation, a content management and delivery company, from 2000 to 2002. Prior to Vignette, heco-founded DataSage, Inc., a software company, and served as its chief executive officer and chairman from 1996 to 2000. Mr. Blundin holds an S.B. degree in computer science from the Massachusetts Institute of Technology. We believe that Mr. Blundin is qualified to serve on our board of directors because of his extensive experience as a director of technology companies and deep knowledge of our company.

Sanju Bansalhas served as a member of our board of directors since May 2014. Mr. Bansal has served as chief executive officer of Hunch Analytics, LLC, a data analytics company that he founded, since November 2013. Previously, Mr. Bansal served in various executive leadership positions and as a director of MicroStrategy Incorporated, a worldwide provider of business intelligence software, including as executive vice president from 1993 to 2013 and chief operating officer from 1993 to 2012. Mr. Bansal also served as a member of MicroStrategy’s board of directors from 1993 to 2013, including as vice chairman from November 2000 to November 2013. Mr. Bansal has served as a director of Cvent, Inc., an event management software company,

since November 1999. Mr. Bansal also served as a director of CSRA Inc., an information technology services company specializing in national security, from November 2015 to April 2018. Mr. Bansal served as a director of The Advisory Board Company from 2009 until the company’s sale in November 2017. Mr. Bansal holds an S.B. degree in electrical engineering from the Massachusetts Institute of Technology and an M.S. degree in computer science from The Johns Hopkins University. We believe that Mr. Bansal is qualified to serve on our board of directors because of his deep background in consulting and information and systems technology, his leadership experience as a senior executive of a public company, his corporate governance experience from serving as a member of public company boards of directors, and his extensive knowledge of relevant technologies.

Seth Birnbaum,David Blundin, one of ourco-founders, has served as our president, chief executive officer and a memberchairman of our board of directors since September 2010. Previously,August 2008. Mr. BirnbaumBlundin is the founder of Link Ventures LLLP, a venture capital firm, where he has served as managing partner since January 2006. He is also the co-foundedco-founder Digital Guardian,of Vestigo Ventures LLC, a venture capital firm, where he has served as managing partner since January 2016. Mr. Blundin is also chairman of the board of Vestmark, Inc., a data securityportfolio management solutions company, in 2003, where he served as chief executive officer from 2001 to 2008. In June 2005, Mr. Blundin co-founded Cogo Labs, Inc., a member of the board of directorsventure studio located in Cambridge, Massachusetts,

where he has served as chairman since its founding and also served as chief executive officer until October 2010.February 2017. From 1997 to 2000, Mr. Blundin was the chief executive officer and chairman of DataSage, Inc., a company he founded that used neural network technology for data analytics in industrial applications including online marketing. In 1996, he2000, DataSage was acquired by Vignette Corporation, where Mr. Blundin served as chief technologist until 2002. Since 2002, Mr. Blundin has founded and co-founded NeoGenesis Pharmaceuticals,at least 10 software and internet companies in addition to Vestmark, including Autotegrity, Inc., where he served as vicea data analytics and online marketing company, and CourseAdvisor, an online research company. Prior to 1997, Mr. Blundin was president and chief executive officer of systems engineering until 2003.Cirrus Recognition Systems, one of the first commercially successful machine-learning companies. Mr. BirnbaumBlundin holds an S.B. degree in mechanical engineeringcomputer science from the Massachusetts Institute of Technology.Technology (MIT), where he researched neural network technology. His thesis at the MIT Artificial Intelligence Laboratory was entitled, “Neural Network Simulations on a Connection Machine.” We believe that Mr. BirnbaumBlundin is qualified to serve on our board of directors due tobecause of his extensive experience in leading emergingas a director of technology companies his extensiveand deep knowledge of our company and the industry in which we compete, and his vision and leadership as aco-founder and as our president and chief executive officer.company.

Paul Deningerhas served as a member of our board of directors since April 2019. Mr. Deninger was a senior advisor with Evercore, an investment banking advisory firm, from June 2016 to February 2020. He joined Evercore as a senior managing director in 2011 and was previously a vice chairman at Jefferies, a global securities and investment banking firm, since 2003. Prior to Jefferies, Mr. Deninger served as chairman and chief executive officer of Broadview, a technology investment banking firm he joined in 1987, from 1996 until its acquisition by Jefferies in 2003. Mr. Deninger also serves as a director of Iron Mountain, a publicly held provider of document storage and information management solutions, and Resideo Technologies Inc., a publicly held provider of residential comfort and securityhome automation products and services.services, and is vice chairman of the board of Epiphany Technology, a publicly held blank check company seeking to acquire a business in the enterprise IT market. Mr. Deninger holds a B.S. degree from Boston College and an M.B.A. degree from Harvard Business School. We believe that Mr. Deninger is qualified to serve on our board of directors due to his deep knowledge of capital markets, merger and acquisition strategies and technology services businesses as well as his extensive management experience. Mr. Deninger was identified as a director candidate by one of our investors.

John LunnyJayme Mendal has served as our president, chief executive officer and a member of our board of directors since June 2014. Mr. Lunnyco-founded Vestmark, Inc., a wealth-management SaaS technology company, and has served as its chief executive officer since 2008 and served as its president and chief operating officer from 2003 to 2008. Prior toco-founding Vestmark, Mr. Lunnyco-founded DataSage, Inc., an enterprise data analytics software company, and served as its vice president of engineering from 1996 to 2001 leading to its acquisition by Vignette Corporation. Following the acquisition, Mr. Lunny served as senior director of engineering at Vignette Corporation from 2001 to 2003. Mr. Lunny holds an S.B. degree in electrical engineering and an S.B. degree in computer science from the Massachusetts Institute of Technology. We believe that Mr. Lunny is qualified to serve on our board of directors because of his experience as an executive in the technology industry.

George Neble has served as a member of our board of directors since May 2018. Since July 2017, Mr. Neble has served as a business consultant. Mr. Neble also serves as a director of Real Goods Solar, Inc., a publicly held provider of solar equipment. From 2012 to June 2017, Mr. Neble served as managing partner of the Boston office of Ernst & Young LLP, an accounting firm. Prior to that, Mr. Neble was a senior assurance partner at Ernst & Young from 2002 to 2012. Mr. Neble is a certified public accountant. He holds a B.S. degree in accounting from Boston College. We believe that Mr. Neble is qualified to serve on our board of directors because of his financial expertise and his experience in public accounting.

John Shields has served as a member of our board of directors since May 2018. He has served as the president of Advisor Guidance, Inc., a business consulting firm, since 2010, as a trustee of Domini Investment Trust, a

registered investment company, since 2004, as a director of Vestmark, Inc. since December 2015, as a director of Cogo Labs, Inc. since May 2008, and as a consultant in the financial services industry since 2002. From October 2016 to June 2018, Mr. Shields served as managing director, head of risk and regulatory compliance at CFGI, LLC, a financial consulting firm. From January 2014 to October 2016, he served as director, head of investment management consulting at Navigant Consulting, Inc. From 1998 to 2002, he served as chief executive officer of Citizens Advisers, Inc., an investment management company. Mr. Shields is a certified public accountant (inactive). He holds a B.S. degree in accounting from Saint Peter’s University. We believe that Mr. Shields is qualified to serve on our board of directors because of his financial and accounting expertise.

Mira Wilczek has served as a member of our board of directors since February 2017. Ms. Wilczek has been a managing director at Link Ventures, a venture capital firm, since June 2015. Since December 2019, Ms. Wilczek has served as a general partner of XLIX Ventures, a family investment office. She previously served as president and chief executive officer of Cogo Labs, Inc., a startup incubator, from October 2016 to November 2019 and was entrepreneur in residence at Cogo Labs from December 2013 until February 2017. Prior to joining Link, Mira founded Red Panda Security, a research consultancy specializing in mobile behavioral analytics, and served as its chief executive officer from 2012 to 2013. From 2009 to 2012, she served as director of business development at Lyric Semiconductor, a fabless semiconductor company. Ms. Wilczek holds an S.B. degree in electrical engineering and computer science and an M.B.A. degree from the Massachusetts Institute of Technology. We believe that Ms. Wilczek is qualified to serve on our board of directors because of her investment and operations experience in the technology industry.

The following table sets forth information regarding our executive officers as of April 22, 2020:

|

| |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

|

The biography of Mr. Birnbaum can be found under “—Nominees for Election.”

Tomas Revesz, one of ourco-founders, has served as our chief technology officer since September 2010. Previously, Mr. Reveszco-founded Digital Guardian, Inc., a data security company, in 2003, where he served as executive vice president of global services until September 2010. Prior to that, he served as vice president of information systems at NeoGenesis Pharmaceuticals, Inc. from 1998 to 2003. Mr. Revesz studied electrical engineering and management science at the Massachusetts Institute of Technology.

John Wagner has served as our chief financial officer and treasurer since April 2014. Previously, Mr. Wagner served as chief financial officer of NuoDB, Inc., a database company, from 2012 to 2014. Prior to that, Mr. Wagner served as the vice president of finance at Carbonite, Inc., an online backup company, from 2011 to 2012, as corporate controller at Constant Contact, Inc. an email marketing company, from 2006 to 2011 and as vice president of finance and chief financial officer at Salesnet, Inc., a sales software company, from 2003 to 2006. Mr. Wagner holds a B.B.A. degree in accounting from the University of Massachusetts, Amherst and an M.B.A. degree from Boston University. He is also a licensed Certified Public Accountant in Massachusetts.

Jayme Mendal has served as our chief operating officer since February 2019.2020. Previously Mr. Mendal served as our chief operating officer from February 2019 to November 2020 and as our chief revenue officer sincefrom September 2017.2017 to February 2019. Mr. Mendal previously served as the vice president of sales and

marketing at PowerAdvocate, Inc., an energy intelligence company, from May 2017 to September 2017. Prior to that, Mr. Mendal served in multiple positions at PowerAdvocate, Inc., including manager of corporate strategy from August 2013 to August 2014, director of corporate strategy and marketing from August 2014 to December 2015 and senior director of sales and marketing from June 2015 to May 2017. From August 2007 to July 2010, he was a management consultant within the growth strategy division of Monitor Deloitte (formerly Monitor Group). Mr. Mendal holds a B.S. degree in finance and economics from Washington University in St. Louis and an M.B.A. degree from Harvard Business School. Mr. Mendal is qualified to serve on our board of directors due to his experience in leading our operations and previously our revenue functions, his extensive knowledge of our company and industry, as well as his vision and leadership as our president and chief executive officer.

George Neble has served as a member of our board of directors since May 2018. Since July 2017, Mr. Neble has served as a business consultant. Mr. Neble has served as the audit committee chair and a board member of LumiraDx, a diagnostics company, since July 2020. Mr. Neble served as a director of Real Goods Solar, Inc., a publicly held provider of solar equipment from June 2019 to July 2021. Mr. Neble has also served as a director of Intapp, Inc., a publicly held leading provider of cloud-based software solutions for the financial services industry, since June 2021. From 2012 to June 2017, Mr. Neble served as managing partner of the Boston office of Ernst & Young LLP, an accounting firm. Prior to that, Mr. Neble was a senior assurance partner at Ernst & Young from 2002 to 2012. Mr. Neble is a certified public accountant. He holds a B.S. degree in accounting from Boston College. We believe that Mr. Neble is qualified to serve on our board of directors because of his financial expertise and his experience in public accounting.

John Shields has served as a member of our board of directors since May 2018. He has served as the president of Advisor Guidance, Inc., a business consulting firm, since 2010, as a trustee of Domini Investment Trust, a registered investment company, since 2004, as a director of Vestmark, Inc. since December 2015, as a director of Cogo Labs, Inc., a startup incubator, since May 2008, and as a consultant in the financial services industry since 2002. From October 2016 to June 2018, Mr. Shields served as managing director, head of risk and regulatory compliance at CFGI, LLC, a financial consulting firm. From January 2014 to October 2016, he served as director, head of investment management consulting at Navigant Consulting, Inc. From 1998 to 2002, he served as chief executive officer of Citizens Advisers, Inc., an investment management company, chief executive officer of Citizens Securities, Inc., a registered broker-dealer, and president and interested trustee of the Citizens Funds mutual fund complex. Mr. Shields is a certified public accountant (inactive). He holds a B.S. degree in accounting from Saint Peter’s University. We believe that Mr. Shields is qualified to serve on our board of directors because of his financial and accounting expertise.

Mira Wilczek has served as a member of our board of directors since February 2017. Ms. Wilczek served as a managing director at Link Ventures LLLP, a venture capital firm from June 2015 to June 2021. Since December 2019, Ms. Wilczek has served as a general partner of XLIX Ventures, a family investment office. She previously served as president and chief executive officer of Cogo Labs, Inc., a startup incubator, from October 2016 to November 2019 and was entrepreneur in residence at Cogo Labs from December 2013 until February 2017. Prior to joining Link Ventures, Ms. Wilczek founded Red Panda Security, a research consultancy specializing in mobile behavioral analytics, and served as its chief executive officer from 2012 to 2013. From 2009 to 2012, she served as director of business development at Lyric Semiconductor, a fabless semiconductor company. Ms. Wilczek holds an S.B. degree in electrical engineering and computer science and an M.B.A. degree from the Massachusetts Institute of Technology. We believe that Ms. Wilczek is qualified to serve on our board of directors because of her investment and operations experience in the technology industry.

Board Diversity Matrix (as of April 28, 2023)

Total Number of Directors: 9

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||||

Part I: Gender Identity | ||||||||||||||||

Directors | 1 | 5 | 3 | |||||||||||||

Part II: Demographic Background | ||||||||||||||||

African American or Black | ||||||||||||||||

Alaskan Native or Native American | ||||||||||||||||

Asian | 1 | |||||||||||||||

Hispanic or Latinx | 1 | |||||||||||||||

Native Hawaiian or Pacific Islander | ||||||||||||||||

White | 1 | 4 | ||||||||||||||

Two or More Races or Ethnicities | 1 | |||||||||||||||

LGBTQ+ | ||||||||||||||||

Did Not Disclose Demographic Background | 1 | |||||||||||||||

| * | Includes Darryl Auguste and John Lunny who will not stand for re-election at the Annual Meeting. |

The following table sets forth information regarding our executive officers as of April 28, 2023:

| Name | Age | Position(s) | ||

Jayme Mendal | 37 | Chief Executive Officer and President, Director | ||

John Wagner | 49 | Chief Financial Officer and Treasurer | ||

David Brainard | 51 | Chief Technology Officer | ||

Julia Brncic | 49 | General Counsel and Secretary |

The biography of Mr. Mendal can be found under “—Nominees for Election.”

John Wagner has served as our chief financial officer and treasurer since March 2014. Previously, Mr. Wagner served as chief financial officer of NuoDB, Inc., a database company, from 2012 to 2014. Prior to that, Mr. Wagner served as the vice president of finance at Carbonite, Inc., an online backup company, from 2011 to 2012, as corporate controller at Constant Contact, Inc., an email marketing company, from 2006 to 2011 and as vice president of finance and chief financial officer at Salesnet, Inc., a sales software company, from 2003 to 2006. Mr. Wagner holds a B.B.A. degree in accounting from the University of Massachusetts, Amherst and an M.B.A. degree from Boston University. He is also a licensed Certified Public Accountant in Massachusetts.

David MasonBrainard has served as our chief technology officer since January 2021 and was previously head of engineering starting in December 2019. Previously, he was head of ad tech systems at Wayfair, Inc., a specialty retail company, for 2019. Prior to that, he led the voluntary benefits engineering organization at Liberty Mutual, an insurance company, from 2016 to 2019. Prior to his role at Liberty Mutual, Mr. Brainard was architecture leader at Bank of America from 2010 to 2016. He also previously served as a principal consultant in IBM’s global integration group, and a manager and architect at BMC Software. Mr. Brainard holds a B.A. degree from Wayne State University and an M.A. degree from Boston University.

Julia Brncic has served as our general counsel and secretary since February 2014. Previously, Mr. Mason served asJanuary 2023 and was previously the senior vice president, chief counsel and corporate secretary of the Cigna Group, a global health company, from 2019 to 2022. From 2008 to 2018, she was the vice president and deputy general counsel at KAYAK Software Corporation, a leading travel metasearch site, from October 2011 to January 2014. From October 2006 to October 2011, he was an associate in the mergers, acquisitions and securities group at Bingham McCutchen, LLP (now Morgan, Lewis & Bockius LLP). Mr. Mason has also served as an adjunct professor at Boston College Law School since 2006. He holds a B.B.A. degree from the University of Massachusetts, Amherst and a J.D. degree from Boston College Law School.

Eugene Suzuki has served as our chief information officer since November 2015 and previously served as our vice president of technology operations beginning in January 2012. Previously, Mr. Suzuki was the vice president of technology solutions at Digital Guardian, Inc. from 2005 to 2011. Mr. Suzuki holds a B.S. degree in Electrical and Computer Engineering from the Worcester Polytechnic Institute. Mr. Suzuki is also a Certified Information Systems Security Professional.

Elyse Neumeier has served as our chief people officer since September 2019. She served as associate director of talent strategy at WayfairExpress Scripts, Inc., a specialty retail company, from September 2016 to September 2019.pharmacy benefit management company. Prior to that, sheMs. Brncic was a consultantshareholder at Bain & Company,Polsinelli, a global consulting firm,law firm. Ms. Brncic holds J.D. and M.B.A. degrees from September 2014 to September 2016. Ms. Neumeier holdsWashington University in St. Louis, and a B.A. degree in Anthropology from Tufts University and an M.B.A. degree from the MIT Sloan School of Management.Purdue University.

Under the rules of the Nasdaq Stock Market, independent directors must comprise a majority of a listed company’s board of directors within a specified period of the completion of its initial public offering.directors. In addition, the rules of the Nasdaq Stock Market require that, subject to specified exceptions, each member of a listed company’s audit and compensation committees be independent and that director nominees be selected or recommended for the board’s selection by independent directors constituting a majority of the independent directors or by a nominations committee comprised solely of independent directors. Under the rules of the Nasdaq Stock Market, a director will only qualify as “independent” if, in the opinion of thatthe company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that such person is “independent” as defined under Nasdaq Stock Market and Securities and Exchange Commission, or the SEC, rules.

Audit committee members must also satisfy the independence criteria set forth in Rule10A-3 under the Securities Exchange Act.Act of 1934, as amended (the “Exchange Act”). In order to be considered independent for purposes of Rule10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors or any other board committee: (1) accept, directly or indirectly, any consulting, advisory or other compensatory fee from the listed company or any of its subsidiaries or (2) be an affiliated person of the listed company or any of its subsidiaries.

We are a “controlled company” as that term is set forth in Nasdaq Stock Market rules. Under Nasdaq Stock Market rules, as a “controlled company,” we are exempt from certain corporate governance requirements, including: (1) the requirement that a majority of our board of directors consist of independent directors, (2) the requirement that director nominees be selected or recommended for the board’s selection by independent directors constituting a majority of the independent directors or by a nominations committee comprised solely of

independent directors, and (3) the requirement that we have a compensation committee composed entirely of independent directors with a written charter specifying, among other things, the scope of the committee’s responsibilities. We currently avail ourselves of certain of these exemptions and, for so long as we are a “controlled company,” we will maintain the option to utilize from time to time some or all of these exemptions. In accordance with these exemptions, we do not have a nominations committee, director nominees are not selected or recommended for the board’s selection by independent directors constituting a majority of the independent directors and our compensation committee is not composed entirely of independent directors. Even as a “controlled company,” we must comply with the rules applicable to audit committees set forth in the Nasdaq Stock Market rules.

At least annually, our board of directors will evaluateevaluates all relationships between us and each director in light of relevant facts and circumstances for the purposes of determining whether a material relationship exists that might signal a potential conflict of interest or otherwise interfere with such director’s ability to satisfy his or her responsibilities as an independent director. Based on this evaluation, our board of directors will makemakes an annual determination of whether each director is independent within the meaning of the independence standards of the Nasdaq Stock Market rules, the Securities and Exchange Commission (“SEC”)SEC and our applicable board committees.

In February 2020,2023, our board of directors determined that each of Messrs. Bansal, Deninger, Lunny, Neble and Shields is “independent” as defined under the rules of the Nasdaq Stock Market. Our board of directors also has determined that Messrs. Bansal, Deninger, Neble and Shields, who comprise our audit committee, and Messrs. Deninger and Lunny, who serve on our compensation committee, satisfy the independence standards for such committees established by the SEC and the rules of the Nasdaq Stock Market, as applicable. Our board of directors determined that Ms. Wilczek, the chair of our compensation committee, does not satisfy the independence standards for such committee established by the SEC and the rules of the Nasdaq Stock Market, as applicable. In making such determinations, our board of directors considered the relationships that each suchnon-employee director has with our company and all other facts and circumstances our board of directors deemed relevant in determining independence, including the beneficial ownership of our capital stock by eachnon-employee director and any institutional stockholder with which he or she is affiliated.

Our corporate governance guidelines provide that the roles of chairman of the board and chief executive officer may be separated or combined. Our board of directors has considered its leadership structure and determined that, at this time, the roles of chairman of the board of directors and chief executive officer should be separate. Separating the chairman and the chief executive officer positions allows our chief executive officer, Mr. Birnbaum,Mendal, to focus on running the business, while allowing the chairman of our board of directors, Mr. Blundin, to lead the board in its fundamental role of providing advice to and oversight of management. Mr. Blundin has been an integral part of the leadership of our company and our board of directors since August 2008, and his strategic vision has guided our growth and performance. Our board of directors believes that Mr. Blundin is best situated to focus the board of director’sdirectors’ attention and efforts on critical matters. Mr. BirnbaumMendal has served as our president since November 2020 and chief executive officer and as a director since September 2010.November 2020. Our board of directors believes that the board’s leadership structure is appropriate because it strikes an effective balance between independent oversight and management participation in the board process.

Code of Business Conduct and Ethics

We have adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of the code is available under the heading “Corporate

Governance–Governance Documents” on the Investors section of our website, which is located at investors.everquote.com. In addition, we intend to post on our website all disclosures that are required by law or Nasdaq Stock Market rules concerning any amendments to, or waivers from, any provision of the code.

We have adopted an insider trading policy that, among other things, expressly prohibits all of our employees, including our named executive officers, as well as our directors, and certain of their family members and related entities, from engaging in short sales of our securities, including short sales “against the box”; purchases or sales of puts, calls or other derivative securities based on our securities; and purchases of financial instruments (including prepaid variable forward contracts, equity swaps, collars and exchange funds) that are designed to hedge or offset any decrease in the market value of our securities.

Corporate Governance Guidelines

Our board of directors has adopted corporate governance guidelines to assist in the exercise of its duties and responsibilities and to serve the best interests of our company and our stockholders. The guidelines provide, among other things, that:

our board of directors’ principal responsibility is to oversee the management of the company;

the independent directors will meet in executive session at least semi-annually;

directors have full and free access to management and, as necessary, independent advisors; and

new directors participate in an orientation program and all directors are expected to participate in continuing director education on an ongoing basis.

A copy of the corporate governance guidelines is posted under the heading “Corporate Governance–Governance Documents” on the Investors section of our website, which is located at investors.everquote.com.

Our board of directors meets on a regularly scheduled basis during the year to review significant developments affecting us and to act on matters requiring its approval. It also holds special meetings when important matters require action between scheduled meetings. Members of senior management regularly attend meetings to report on and discuss their areas of responsibility. Our board of directors held seven meetings (including regularly scheduled and special meetings) during the fiscal year ended December 31, 2019.2022.

During 2019,2022, each director attended at least 75% of the aggregate of (i) the total number of meetings of our board of directors held during the period for which he or she has been a director and (ii) the total number of meetings held by the audit committee and compensation committee of our board of directors during any periods in which he or she served. Our board of directors periodically holds executive sessions of the independent directors. Executive sessions do not include employee directors or directors who do not qualify as independent under the Nasdaq Stock Market and SEC rules.

It is our policy that members of our board of directors are encouraged to attend annual meetings of our stockholders. All directors then serving attended the 2022 Annual Meeting of Stockholders.

Our amended and restated bylaws provide that our board of directors may delegate responsibility to committees. Our board of directors has established an audit committee and a compensation committee, which operate under

charters approved by our board of directors. Both the audit committee charter and the compensation committee charter are available under the heading “Corporate Governance–Governance—Governance Documents” on the Investors section of our website, which is located at investors.everquote.com.

Our audit committee’s responsibilities include:

appointing, approving the compensation of, and assessing the independence of our registered public accounting firm;

overseeing the work of our registered public accounting firm, including through the receipt and consideration of reports from such firm;

reviewing and discussing with management and the registered public accounting firm our annual and quarterly financial statements and related disclosures;

coordinating our board of directors’ oversight of our internal control over financial reporting, disclosure controls and procedures, and code of business conduct and ethics;

discussing our risk management policies;

establishing policies regarding hiring employees from the registered public accounting firm and procedures for the receipt and retention of accounting related complaints and concerns;

meeting independently with our registered public accounting firm and management;

reviewing and approving or ratifying any related person transactions; and

preparing the audit committee report required by SEC rules.

All audit services and allnon-audit services, other than de minimisnon-audit services, to be provided to us by our independent registered public accounting firm must be approved in advance by our audit committee.

The members of our audit committee are Messrs. Bansal, Deninger, Neble and Shields. Mr. Neble is the chair of our audit committee. Our board of directors has determined that Mr. Neble is an “audit committee financial expert” as defined by applicable SEC rules.

Our audit committee held sixseven meetings during the fiscal year ended December 31, 2019.2022. Our audit committee operates under a written charter adopted by our board of directors, a current copy of which is available under the heading “Corporate Governance–Governance—Governance Documents” on the Investors section of our website, which is located at investors.everquote.com.

Our compensation committee’s responsibilities include:

reviewing and approving, or making recommendations to our board of directors with respect to, the compensation of our chief executive officer and our other executive officers;

reviewing and making recommendations to our board of directors with respect to incentive-compensation and equity-based plans;

recommending to the independent directors serving on our board of directors to approve anytax-qualified,non-discriminatory employee benefit plans;

reviewing and making recommendations to our board of directors with respect to director compensation;

reviewing and discussing annually with management our “Compensation Discussion and Analysis” disclosure, if applicable;disclosure; and

preparing the compensation committee report to the extent required by SEC rules.

The members of our compensation committee are Messrs. Lunny and Deninger and Ms. Wilczek. Ms. Wilczek is the chair of our compensation committee. In designing our executive compensation program, our compensation committee engages the services of an independent compensation consulting firm.

Executive Compensation Process

Roles of Our Compensation Committee, Board of Directors and Management

Our executive compensation program is administered by the compensation committee was formed in July 2019 and held two meetings during the fiscal year ended December 31, 2019. Our compensation committee operates under a written charter adopted byof our board of directors, a current copy of which is available undersubject to the heading “Corporate Governance–Governance Documents” on the Investors sectionoversight and, with respect to equity awards, approval of our website, which is located at investors.everquote.com.

full board of directors. Our compensation committee may,reviews our executive compensation practices on an annual basis and based on this review approves, in its sole discretion, retainconsultation with our board of directors, base salary and bonus amounts, and with respect to equity awards, makes recommendations to our board of directors. The board of directors then approves or obtainmodifies the adviceequity awards recommended by the compensation committee. While our compensation committee is responsible for approving salaries and bonuses, the compensation committee provides regular compensation related updates to our board of one or moredirectors and provides our board of directors with an opportunity to make inquiries and consult on executive compensation consultants. Ourmatters.

As a part of determining executive officer compensation, the compensation committee receives base salary, bonus and equity compensation recommendations from our chief executive officer. At the invitation of the compensation committee, certain members of our senior management also participate in compensation committee meetings to share their perspective and relevant information on topics that the compensation committee is discussing.

Role of the Compensation Committee’s Independent Compensation Consultant

In designing our executive compensation program, our compensation committee engages the services of an independent compensation consulting firm. During 2022, our compensation committee engaged Compensia, Inc. as its independent compensation consultant to provide comparative data on executive compensation practices in our industry, to assist our compensation committee in developing an appropriate list of peer companies, and to advise on our executive compensation program for 20192022 and 2020 generally.2023. Our compensation committee also engaged Compensia, Inc. for recommendations and review ofnon-employee director compensation in 2019 and 2020.

Although our compensation committee and board consider the advice and recommendations of independent compensation consultants as to our executive compensation program, our compensation committee and board ultimately make their own decisions about these matters. In the future, we expect that our compensation committee will continue to engage independent compensation consultants to provide additional guidance on our executive compensation programs and to conduct further competitive benchmarking against a peer group of publicly traded companies.

Our compensation committee will reviewreviews information regarding the independence and potential conflicts of interest of any compensation consultant it may engage, taking into account, among other things, the factors set forth in the Nasdaq Stock Market rules. With respect to services provided in 2019,2022, our compensation committee concluded that the engagement of Compensia, Inc. did not raise any conflict of interest. Outside of services provided for the

Although our compensation committee and board of directors consider the advice and recommendations of an independent compensation consultant as to our executive compensation program, our compensation committee and board Compensia, Inc. provided nominal additional services to us in 2019 related to benchmarking data with respect to certain executive andnon-executive positions in an effort to ensureof directors ultimately make their own decisions about these matters. In the future, we expect that our compensation was competitive so that we could attract, reward, motivate and retain our employees. The total amount paidcommittee will continue to Compensia, Inc. in connection with theseengage an independent compensation consultant to provide additional engagements was less than $120,000 in 2019.

Compensation Committee Interlocks and Insider Participation

None ofguidance on our executive officers serves ascompensation programs and to conduct further competitive benchmarking against a memberpeer group of the board of directors orpublicly traded companies.

Our compensation committee or other committee serving an equivalent function, of any entity that has one or more executive officers who serve as members ofoperates under a written charter adopted by our board of directors, ora current copy of which is available under the heading “Corporate Governance—Governance Documents” on the Investors section of our website, which is located at investors.everquote.com. Our compensation committee.committee held nine meetings during the fiscal year ended December 31, 2022.

Oversight of Risk

Our board of directors oversees our risk management processes directly and through its audit committee. Our management is responsible for risk management on aday-to-day basis. The role of our board of directors and its audit committee is to oversee the risk management activities of our management. They fulfill this duty by discussing with management the policies and practices utilized by management in assessing and managing risks and providing input on those policies and practices. In general, our board of directors oversees risk management activities relating to business strategy, acquisitions, capital allocation, organizational structure and certain operational risks, and our audit committee oversees risk management activities related to financial controls and legal and compliance risks, including with respect to enterprise risk, fraud and cybersecurity. The audit

committee reports to the full board of directors on a regular basis, including reports with respect to the committee’s risk oversight activities as appropriate. In addition, because risk issues often overlap, the committee from time to time requests that the full board of directors discuss particular risks.

Director Nomination Process

Our board of directors is responsible for selecting its own members. The process followed by our board to identify and evaluate director candidates may include requests toincludes: potentially requesting recommendations from members of our board of directors and others for recommendations,recommendations; evaluation of the performance on our board of directors and its audit committee of any existing directors being considered for nomination,nomination: consideration of biographical information and background material relating to potential candidatescandidates; and, particularly in the case of potential candidates who are not then serving on our board of directors, interviews of selected candidates by members of our board of directors.

Generally, our board identifies candidates for director nominees in consultation with management, through the use of search firms or other advisors, through the recommendations submitted by stockholders or through such other methods as our board deems to be helpful to identify candidates. Once candidates have been identified, our board confirms that the candidates meet all of the minimum qualifications for director nominees established by our board.

Our board of directors may gather information about the candidates through interviews, detailed questionnaires, comprehensive background checks or any other means that our board deems to be appropriate in the evaluation process. Our board then discusses and evaluates the qualities and skills of each candidate, both on an individual basis and taking into account the overall composition and needs of our board of directors. Based on the results of the evaluation process, our board determines the persons to be nominated for election as directors. In considering whether to nominate any particular person for election as a director, our board applies the criteria set forth in our corporate governance guidelines described above under “Corporate Governance Guidelines.” Consistent with these criteria, our board expects every nominee to have the following attributes or characteristics, among others: integrity, honesty, adherence to high ethical standards, business acumen, good judgment and a commitment of service to our company, including a commitment to understand our business and industry. Our board considers the value of diversity when selecting nominees, and believes that our board of directors, taken as a whole, should embody a diverse set of skills, experiences and abilities. The board does not make any particular weighting of diversity or any other characteristic in evaluating nominees and directors.

All of the director nominees are currently members of our board of directors. The biographies of such director nominees under the heading “Nominees for Election” in this Proxy Statement indicate the experience, qualifications, attributes and skills of each of the director nominees that led our board of directors to conclude he or she should continue to serve as a director of our company. Our board of directors believes that each of the nominees has the individual attributes and characteristics required of a director of our company, and that the nominees as a group possess the skill sets and specific experience desired of our board of directors as a whole.

Stockholders may recommend individuals for consideration by our board of directors as potential director candidates by submitting their names, together with appropriate biographical information and background materials, and information with respect to the stockholder or group of stockholders making the recommendation, including the number of shares of capital stock owned by such stockholder or group of stockholders, to our Secretary at EverQuote, Inc., 210 Broadway, Cambridge, MA 02139. The specific requirements for the information that is required to be provided for such recommendations to be considered are specified in our amended and restated bylaws and must be received by us no later than the date referenced below under the heading “Procedures for Submitting Stockholder Proposals.” Assuming that appropriate biographical and background material has been provided on a timely basis, our board will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

Stockholders also have the right under our amended and restated bylaws to directly nominate director candidates, without any action or recommendation on the part of our board of directors, by following the procedures set forth below under the heading “Procedures for Submitting Stockholder Proposals.”

In evaluating proposed director candidates, our board may consider, in addition to the minimum qualifications and other criteria approved by it from time to time, all facts and circumstances that it deems appropriate or advisable, including, among other things, the skills of the proposed director candidate, his or her depth and breadth of professional experience or other background characteristics, his or her independence and the needs of our board of directors.

Stockholders or other interested parties may contact our board of directors or one or more of our directors with issues or questions about EverQuote, by mailing correspondence to our General Counsel at 210 Broadway, Cambridge, MA 02139. Our legal team will review incoming communications directed to our board of directors and, if appropriate, will forward such communications to the appropriate member(s) of the board of directors or, if none is specified, to the chairman of our board of directors. For example, we will generally not forward a communication that is primarily commercial in nature, is improper or irrelevant, or is a request for general information about EverQuote.

We believe that although a portion of the compensation provided to our executive officers and other employees is performance-based, our executive compensation program does not encourage excessive or unnecessary risk taking. This is primarily due to the fact that our compensation programs are designed to encourage our executive officers and other employees to remain focused on both short-term and long-term strategic goals, in particular in connection with ourpay-for-performance compensation philosophy that applies to our executive officers. In addition, we believe that the equity compensation component of our executive compensation program assists in protecting against excessive or unnecessary risk taking by providing our executives with a strong link to our long-term performance, creating an ownership culture and helping to align the interests of our executives and our stockholders. As a result, we do not believe that our compensation programs are reasonably likely to have a material adverse effect on us.

RATIFICATION OF THE APPOINTMENT OF

OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have appointed PricewaterhouseCoopers LLP as our independent registered public accounting firm to perform the audit of our consolidated financial statements for the fiscal year ending December 31, 2020,2023, and we are asking you and other stockholders to ratify this appointment. PricewaterhouseCoopers LLP has served as our independent registered public accounting firm since 2014.